All Categories

Featured

Table of Contents

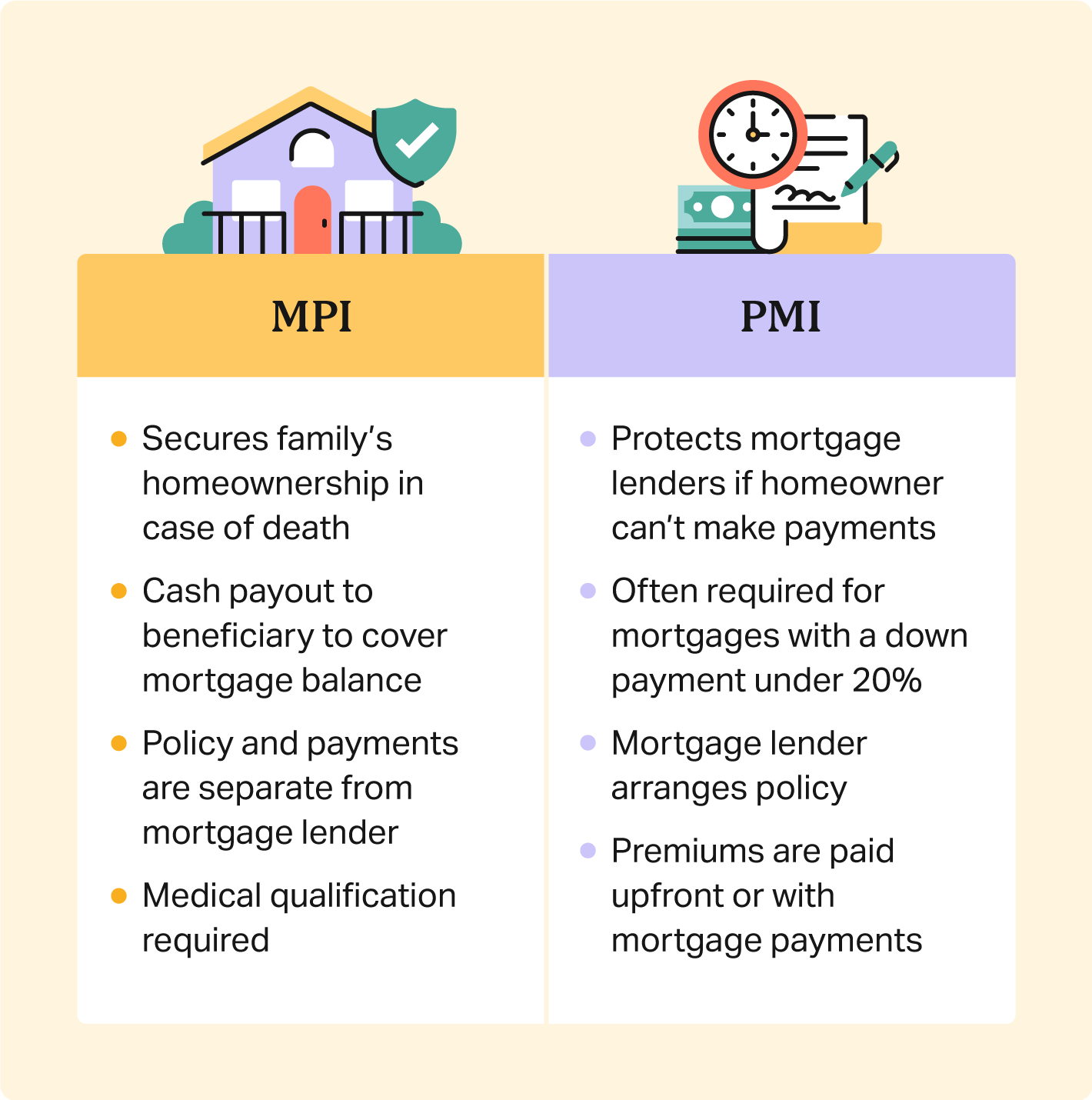

Maintaining all of these phrases and insurance policy types straight can be a frustration. The adhering to table positions them side-by-side so you can promptly distinguish among them if you obtain confused. Another insurance policy protection kind that can repay your mortgage if you die is a basic life insurance coverage plan

A is in area for a set number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away throughout that term. An offers protection for your whole life period and pays out when you pass away.

One usual guideline is to go for a life insurance policy that will pay out up to ten times the policyholder's salary amount. Alternatively, you might pick to utilize something like the DIME approach, which adds a family members's debt, revenue, home loan and education costs to determine just how much life insurance policy is needed (mortgage protection insurance cover).

It's additionally worth noting that there are age-related limits and limits enforced by nearly all insurance companies, who typically will not give older purchasers as lots of choices, will certainly bill them more or may deny them outright.

Right here's just how home mortgage protection insurance gauges up versus conventional life insurance. If you're able to qualify for term life insurance policy, you should stay clear of home loan protection insurance (MPI).

In those scenarios, MPI can give great tranquility of mind. Every mortgage protection alternative will certainly have various regulations, policies, advantage alternatives and disadvantages that require to be evaluated meticulously versus your accurate scenario.

About Mortgage Protection Insurance

A life insurance plan can help pay off your home's mortgage if you were to pass away. It's one of numerous manner ins which life insurance coverage may aid safeguard your enjoyed ones and their monetary future. Among the very best ways to factor your home loan right into your life insurance coverage demand is to talk with your insurance coverage representative.

Instead of a one-size-fits-all life insurance policy plan, American Domesticity Insurance policy Business uses plans that can be made especially to meet your household's needs. Below are a few of your choices: A term life insurance policy plan. mortgage protection plan disability insurance is active for a certain quantity of time and generally uses a bigger quantity of coverage at a reduced rate than a permanent policy

A entire life insurance policy plan is just what it seems like. Rather than just covering a set number of years, it can cover you for your whole life. It additionally has living benefits, such as money value buildup. * American Domesticity Insurer provides various life insurance policy policies. Talk with your representative concerning personalizing a plan or a mix of policies today and obtaining the satisfaction you deserve.

Your representative is a terrific source to answer your questions. They might additionally be able to aid you locate voids in your life insurance policy coverage or new ways to reduce your various other insurance plan. ***Yes. A life insurance policy beneficiary can select to utilize the survivor benefit for anything - insurance and mortgage services. It's an excellent means to aid protect the monetary future of your family if you were to pass away.

Life insurance coverage is one method of helping your family members in paying off a mortgage if you were to pass away before the mortgage is totally paid back. Life insurance policy proceeds may be made use of to assist pay off a home loan, but it is not the exact same as home loan insurance that you may be needed to have as a condition of a funding.

Buy Payment Protection Insurance

Life insurance policy may aid guarantee your home stays in your family by supplying a survivor benefit that may assist pay down a home mortgage or make crucial purchases if you were to pass away. Call your American Family Insurance agent to talk about which life insurance coverage policy best fits your needs. This is a short description of insurance coverage and is subject to policy and/or motorcyclist conditions, which might differ by state.

The words life time, long-lasting and long-term are subject to plan terms and problems. * Any finances taken from your life insurance policy plan will accrue interest. mortgage life insurance and critical illness cover. Any impressive car loan balance (car loan plus rate of interest) will be deducted from the survivor benefit at the time of case or from the cash worth at the time of abandonment

Discounts do not use to the life policy. Policy Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home loan security insurance policy (MPI) is a various kind of safeguard that might be practical if you're incapable to repay your home loan. While that added protection appears great, MPI isn't for everyone. Below's when home mortgage protection insurance coverage deserves it. Home loan security insurance policy is an insurance coverage that settles the remainder of your mortgage if you pass away or if you become disabled and can not function.

Like PMI, MIP protects the lender, not you. Nonetheless, unlike PMI, you'll pay MIP for the period of the financing term, for the most part. Both PMI and MIP are called for insurance policy coverages. An MPI plan is entirely optional. The amount you'll spend for mortgage defense insurance relies on a range of variables, consisting of the insurance company and the current balance of your home mortgage.

Still, there are benefits and drawbacks: A lot of MPI plans are released on a "ensured acceptance" basis. That can be useful if you have a wellness condition and pay high rates permanently insurance policy or struggle to obtain coverage. mortgage protection payment. An MPI plan can supply you and your family with a complacency

Life Insurance Mortgage Protection

You can pick whether you require home mortgage protection insurance policy and for just how lengthy you need it. You could want your mortgage protection insurance policy term to be close in size to how long you have left to pay off your home mortgage You can terminate a home mortgage defense insurance plan.

Latest Posts

Burial Insurance For Senior

Instant Term Life Insurance No Medical Exam

Instant Universal Life Insurance Quotes