All Categories

Featured

Table of Contents

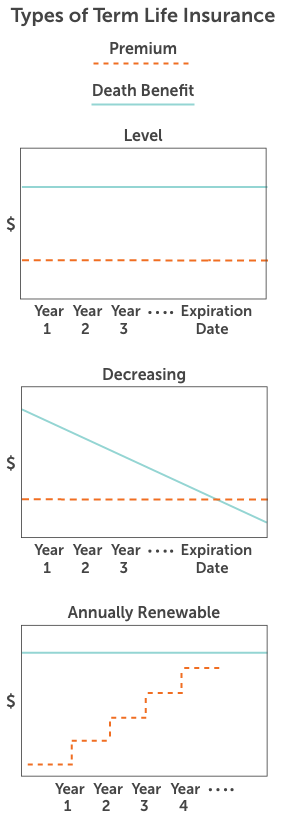

Level term life insurance policy is a plan that lasts a collection term generally in between 10 and thirty years and comes with a level survivor benefit and level costs that remain the same for the whole time the policy is in impact. This indicates you'll know exactly just how much your settlements are and when you'll need to make them, permitting you to budget appropriately.

Degree term can be an excellent option if you're aiming to buy life insurance policy protection for the initial time. According to LIMRA's 2023 Insurance Barometer Research Study, 30% of all grownups in the U.S. need life insurance policy and don't have any type of sort of plan yet. Degree term life is predictable and economical, which makes it among one of the most preferred kinds of life insurance.

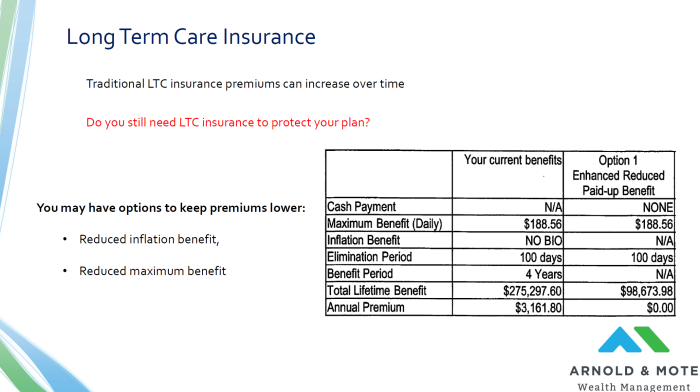

A 30-year-old male with a similar profile can anticipate to pay $29 monthly for the very same coverage. AgeGender$250,000 protection amount$500,000 coverage quantity$1 million insurance coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Ordinary month-to-month rates are computed for male and women non-smokers in a Preferred health and wellness classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance coverage policy.

Rates might differ by insurer, term, protection amount, wellness course, and state. Not all policies are offered in all states. Rate image legitimate as of 09/01/2024. It's the most affordable kind of life insurance policy for many people. Degree term life is far more budget friendly than a similar entire life insurance plan. It's very easy to manage.

It permits you to budget and plan for the future. You can quickly factor your life insurance right into your budget due to the fact that the premiums never ever transform. You can prepare for the future simply as easily because you recognize exactly just how much money your loved ones will certainly receive in the event of your absence.

The Ultimate Guide: What is Level Term Life Insurance Policy?

In these situations, you'll normally have to go through a new application procedure to get a much better price. If you still require coverage by the time your level term life policy nears the expiry date, you have a couple of alternatives.

A lot of level term life insurance policies come with the choice to restore coverage on a yearly basis after the preliminary term ends. The expense of your plan will certainly be based upon your existing age and it'll raise each year. This could be a great option if you only need to extend your insurance coverage for a couple of years or else, it can get costly pretty promptly.

Degree term life insurance policy is one of the cheapest coverage choices on the marketplace because it offers basic protection in the kind of death advantage and only lasts for a set time period. At the end of the term, it ends. Entire life insurance, on the other hand, is substantially extra expensive than degree term life because it doesn't end and includes a cash money worth function.

Not all plans are available in all states. Degree term is a wonderful life insurance policy alternative for many individuals, however depending on your protection needs and personal situation, it may not be the ideal fit for you.

This can be a good alternative if you, for instance, have just stop smoking and require to wait two or three years to use for a degree term policy and be eligible for a reduced price.

With a reducing term life policy, your survivor benefit payment will certainly lower in time, however your settlements will stay the exact same. Decreasing term life plans like mortgage protection insurance policy usually pay out to your lending institution, so if you're searching for a policy that will pay to your enjoyed ones, this is not a great suitable for you.

What is What Is Level Term Life Insurance? The Key Points?

Boosting term life insurance policy plans can help you hedge versus rising cost of living or plan financially for future kids. On the other hand, you'll pay more upfront for less coverage with a boosting term life plan than with a level term life policy. Level premium term life insurance policies. If you're unsure which sort of policy is best for you, working with an independent broker can help.

Once you have actually determined that level term is best for you, the next action is to purchase your plan. Right here's exactly how to do it. Compute just how much life insurance policy you need Your coverage quantity need to attend to your family members's long-term monetary needs, including the loss of your revenue in the occasion of your death, in addition to financial obligations and day-to-day expenses.

One of the most prominent kind is currently 20-year term. Most business will certainly not offer term insurance to an applicant for a term that ends past his or her 80th birthday celebration. If a policy is "renewable," that means it continues active for an extra term or terms, approximately a defined age, also if the health and wellness of the insured (or other elements) would create him or her to be rejected if she or he got a brand-new life insurance policy policy.

Costs for 5-year eco-friendly term can be level for 5 years, after that to a new price showing the new age of the guaranteed, and so on every five years. Some longer term plans will certainly assure that the premium will not increase during the term; others do not make that assurance, allowing the insurer to elevate the rate throughout the plan's term.

What is Guaranteed Level Term Life Insurance? All You Need to Know?

This means that the policy's proprietor deserves to transform it right into an irreversible kind of life insurance policy without added proof of insurability. In many sorts of term insurance, consisting of property owners and vehicle insurance, if you haven't had an insurance claim under the plan by the time it runs out, you obtain no reimbursement of the costs.

Some term life insurance coverage customers have been unhappy at this result, so some insurance firms have produced term life with a "return of premium" function. The costs for the insurance policy with this feature are often substantially greater than for plans without it, and they generally need that you maintain the plan active to its term or else you waive the return of premium advantage.

Level term life insurance coverage premiums and fatality benefits remain regular throughout the plan term. Level term plans can last for periods such as 10, 15, 20 or thirty years. Degree term life insurance is typically a lot more economical as it doesn't develop cash money value. Level term life insurance is one of the most common kinds of defense.

While the names usually are made use of mutually, degree term insurance coverage has some crucial distinctions: the premium and fatality benefit remain the very same for the duration of coverage. Level term is a life insurance policy policy where the life insurance premium and survivor benefit stay the very same for the period of insurance coverage.

Latest Posts

Burial Insurance For Senior

Instant Term Life Insurance No Medical Exam

Instant Universal Life Insurance Quotes