All Categories

Featured

Table of Contents

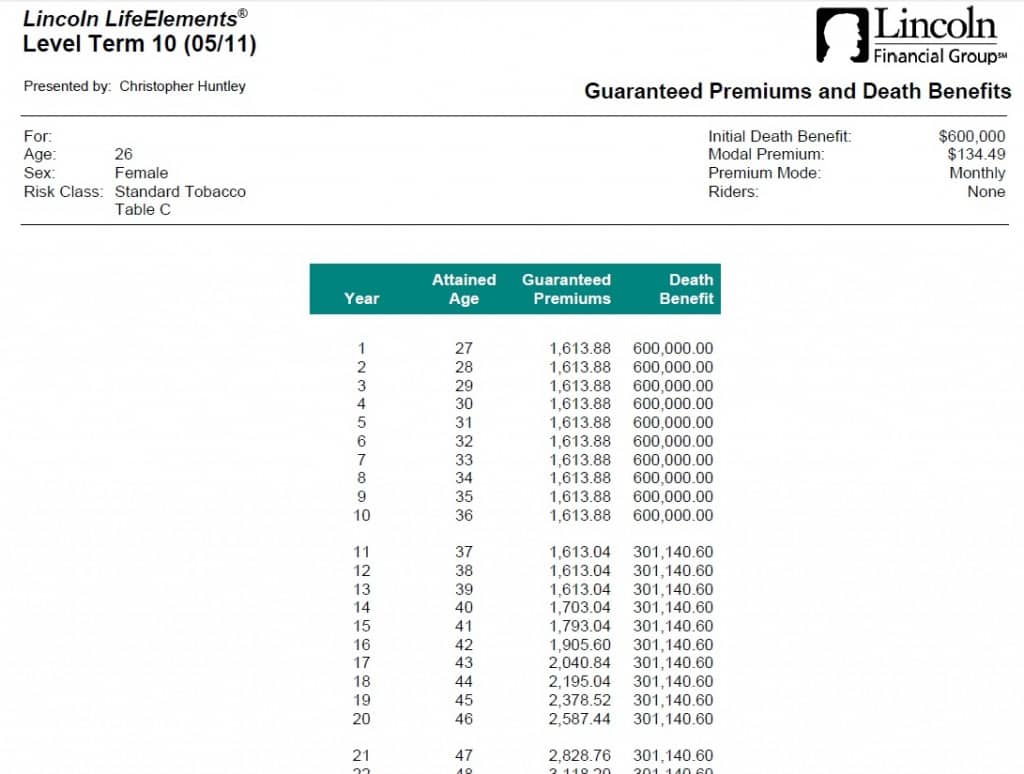

A degree term life insurance policy policy can offer you comfort that the people that depend upon you will have a fatality advantage during the years that you are preparing to support them. It's a way to assist look after them in the future, today. A degree term life insurance policy (in some cases called level costs term life insurance coverage) policy provides protection for an established variety of years (e.g., 10 or 20 years) while keeping the premium settlements the same for the duration of the plan.

With level term insurance coverage, the cost of the insurance coverage will stay the very same (or potentially lower if dividends are paid) over the term of your policy, usually 10 or 20 years. Unlike permanent life insurance coverage, which never ever ends as long as you pay costs, a level term life insurance policy policy will certainly finish at some factor in the future, normally at the end of the period of your level term.

What Makes 20-year Level Term Life Insurance Stand Out?

Due to this, lots of people make use of irreversible insurance as a stable economic preparation device that can offer many requirements. You may have the ability to convert some, or all, of your term insurance policy during a collection duration, generally the initial ten years of your plan, without needing to re-qualify for coverage even if your health has actually transformed.

As it does, you may desire to add to your insurance coverage in the future - Level term life insurance meaning. As this happens, you may want to eventually decrease your death benefit or take into consideration converting your term insurance to a permanent plan.

So long as you pay your premiums, you can rest easy knowing that your enjoyed ones will certainly obtain a survivor benefit if you die during the term. Lots of term policies permit you the capacity to convert to long-term insurance coverage without needing to take an additional wellness examination. This can permit you to take advantage of the fringe benefits of a permanent policy.

Degree term life insurance policy is one of the easiest paths into life insurance policy, we'll discuss the benefits and disadvantages so that you can choose a strategy to fit your demands. Level term life insurance policy is one of the most typical and standard type of term life. When you're trying to find short-lived life insurance policy strategies, degree term life insurance policy is one route that you can go.

You'll fill up out an application that has basic individual details such as your name, age, etc as well as a much more thorough survey regarding your medical background.

The short solution is no., for instance, allow you have the convenience of death advantages and can accumulate cash worth over time, meaning you'll have more control over your benefits while you're alive.

What is Level Term Life Insurance Meaning? Pros, Cons, and Features

Bikers are optional arrangements added to your plan that can offer you added benefits and protections. Anything can happen over the program of your life insurance coverage term, and you desire to be ready for anything.

There are instances where these advantages are built right into your policy, but they can also be available as a different addition that calls for additional payment.

Latest Posts

Burial Insurance For Senior

Instant Term Life Insurance No Medical Exam

Instant Universal Life Insurance Quotes